Canadian Pension Guarantees

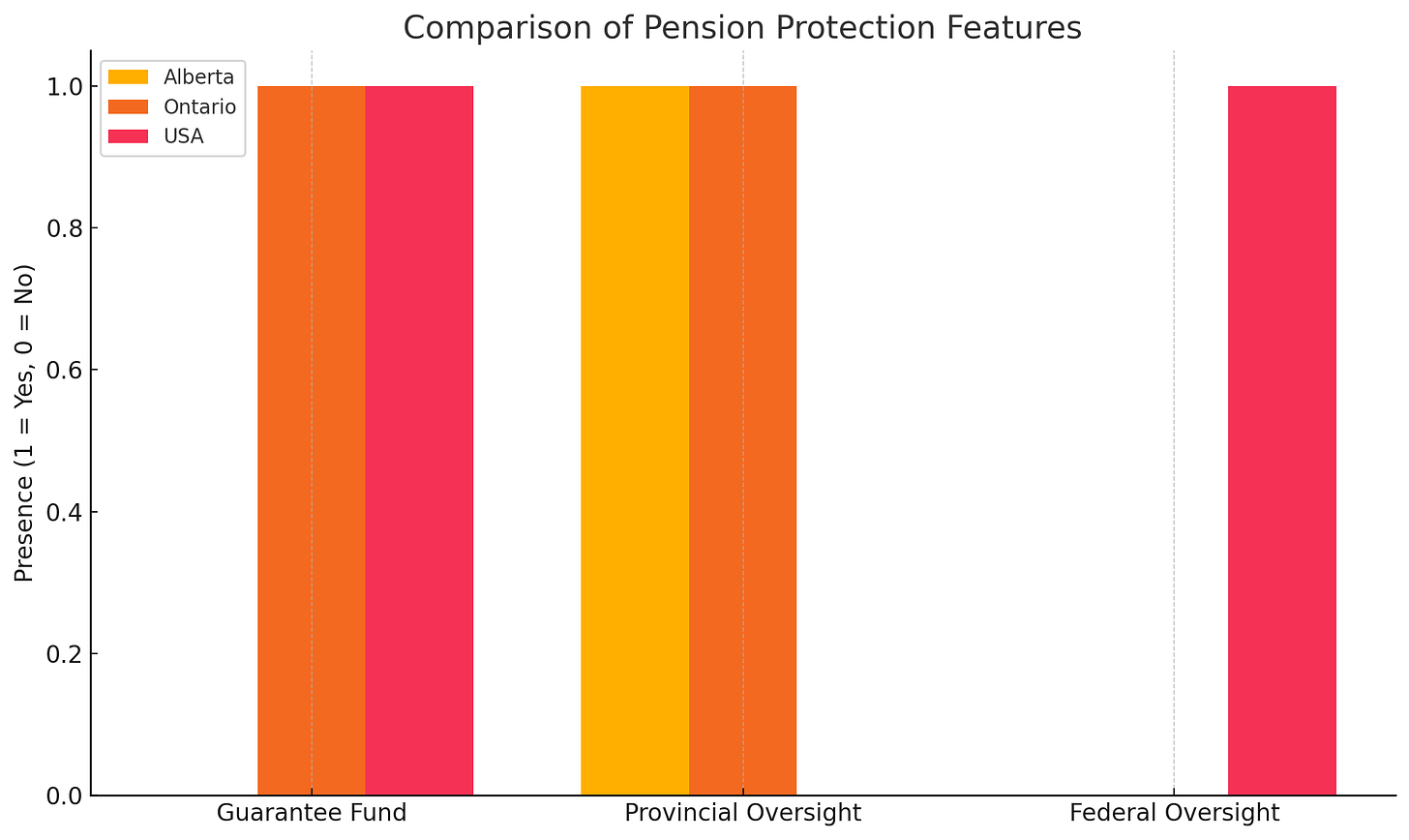

Canada’s pension protections vary widely, and Alberta’s lack of a provincial guarantee fund leaves workers more exposed. This article breaks down the differences between Alberta’s risk environment, Ontario’s limited safety net, and the U.S. PBGC-backed federal system—with charts to compare.

In the United States, if a private-sector pension plan collapses due to employer bankruptcy, the federal Pension Benefit Guaranty Corporation (PBGC) steps in to protect beneficiaries. For American workers and retirees, this backstop offers some reassurance that their promised benefits won’t vanish in the event of corporate insolvency.

But what about in Canada? Does an equivalent safety net exist for Canadians counting on defined benefit (DB) pensions?

The answer is nuanced—and for workers in Alberta, it carries significant implications. Unlike the U.S., Canada does not have a national pension guarantee fund, and most provinces, including Alberta, provide no backstop should a private-sector pension plan fail. Only one province, Ontario, has a limited pension guarantee mechanism in place. Understanding these differences is crucial for both employees and employers in Alberta and across Canada.

The Role of PBGC in the U.S.: A Brief Overview

Founded in 1974 under the Employee Retirement Income Security Act (ERISA), the Pension Benefit Guaranty Corporation (PBGC) is a U.S. government agency that insures private-sector defined benefit pension plans. When a covered plan is terminated—typically because the employer becomes insolvent—PBGC steps in to pay the pension benefits up to legal limits.

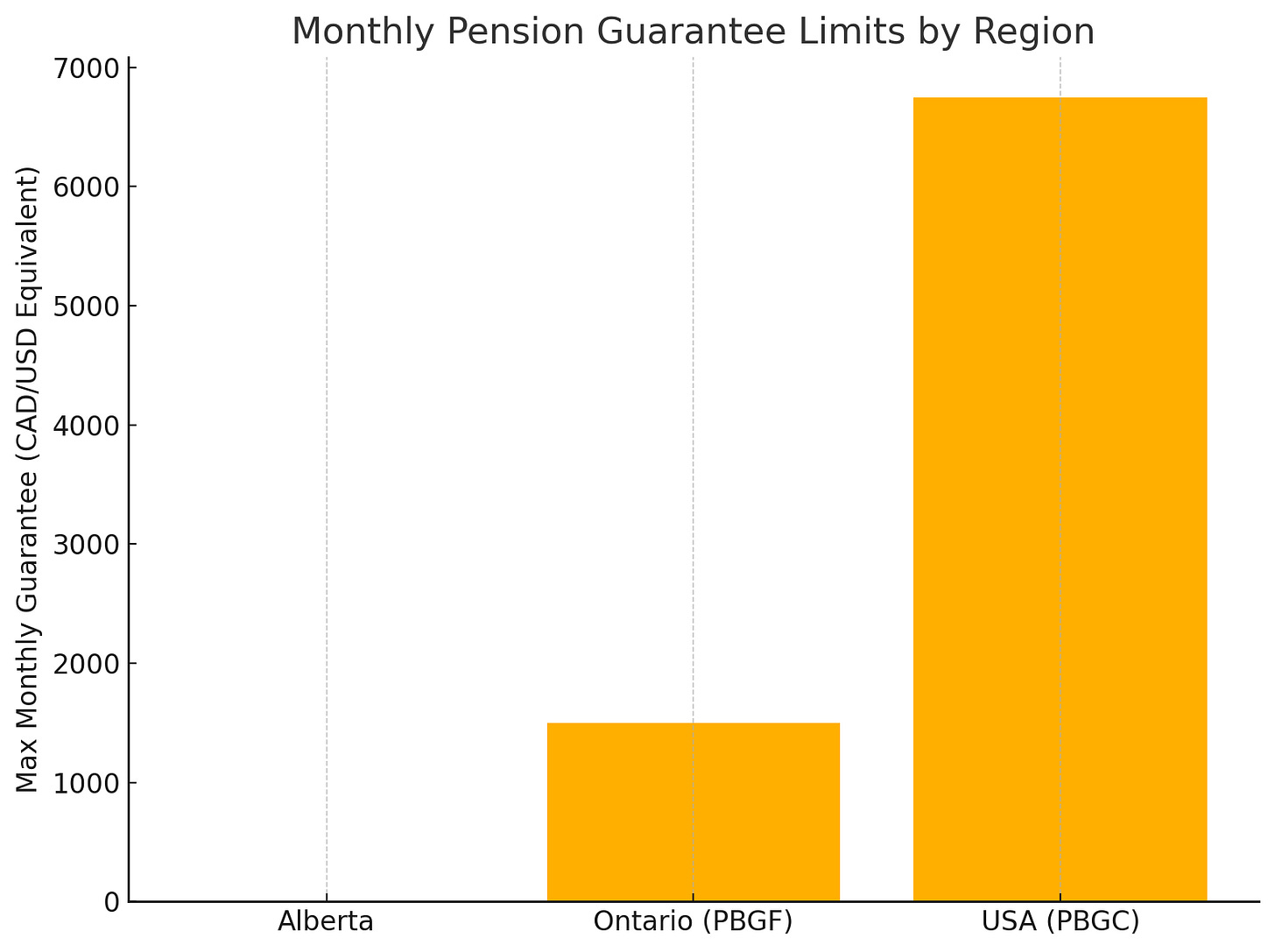

As of 2024, the PBGC’s maximum guaranteed benefit is approximately $6,750 per month for a retiree aged 65. While this doesn’t always make plan members whole, it significantly cushions the blow and ensures some retirement security.

This federal system covers tens of millions of Americans and reflects a national commitment to pension stability.

This chart makes it clear: the protection offered by PBGC in the U.S. far exceeds what is available in Canada.

Canada’s Decentralized Pension System

Canada’s pension oversight is highly decentralized, with regulatory authority resting at the provincial level—except for federally regulated industries like banking, telecommunications, and transportation, which are overseen by the Office of the Superintendent of Financial Institutions (OSFI).

Each province enacts its own pension laws and enforces its own standards for solvency, funding, governance, and disclosure. Alberta, for example, administers pensions under the Employment Pension Plans Act (EPPA) and related regulations.

This decentralized approach has benefits—regulatory flexibility and responsiveness to local economic conditions—but it also means there is no national safety net equivalent to the PBGC.

The Exception: Ontario’s Pension Benefits Guarantee Fund (PBGF)

Ontario is the only Canadian province that offers a form of pension benefit insurance. Its Pension Benefits Guarantee Fund (PBGF), established in 1980, provides limited protection for members of Ontario-registered defined benefit plans.

Under the PBGF, retirees can receive up to $1,500 per month in guaranteed pension income if their employer goes bankrupt and the plan is underfunded. While this amount is far lower than what PBGC guarantees in the U.S., it still represents a meaningful layer of security that doesn’t exist elsewhere in Canada.

However, the PBGF only applies to:

Plans registered in Ontario

Defined benefit (not defined contribution) plans

Plans that meet the eligibility requirements and pay annual PBGF assessments

For Alberta workers, the PBGF offers no protection—they’re entirely outside its jurisdiction.

This visual reinforces the stark contrast in protection across jurisdictions.

How Alberta Handles Pension Plan Risk

In Alberta, defined benefit pension plans are regulated by the Alberta Superintendent of Pensions, part of Alberta Treasury Board and Finance. These plans must comply with Alberta’s Employment Pension Plans Act (EPPA), which sets rules for funding, investment, administration, and member disclosure.

However, unlike Ontario, Alberta does not have a pension guarantee fund. If a pension plan becomes insolvent and is terminated with insufficient assets, there is no provincial safety net to make up the difference.

Here’s what Alberta does require instead:

1. Funding Standards

Alberta mandates that DB pension plans meet minimum funding thresholds based on actuarial valuations. These include:

Going-concern funding (long-term expected cost)

Solvency funding (if the plan were wound up immediately)

Plans must file actuarial valuations at least once every three years (more frequently if underfunded) and must take corrective action if funding deficits arise.

2. Plan Assets Held in Trust

All pension assets must be held in a segregated trust account or insurance contract, separate from employer assets. This ensures that, even in bankruptcy, pension assets are not subject to claims from creditors.

3. Regulatory Oversight

The Superintendent of Pensions can enforce compliance, demand corrective measures, and investigate potential governance failures. However, this role is strictly supervisory—the regulator does not offer financial protection to plan members in the event of a collapse.

What Happens If a Pension Plan Fails in Alberta?

If a company in Alberta sponsoring a DB pension plan goes bankrupt, here’s a simplified breakdown of what could occur:

Plan is Terminated – The plan is wound up and assets are distributed.

Actuarial Valuation Performed – Determines how much money is available relative to liabilities.

Payouts Prioritized – Pensioners may receive reduced payments if the plan is underfunded.

No Top-Up from Government – Unlike PBGC or PBGF, Alberta provides no guarantee. Members bear the risk of funding shortfalls.

In practical terms, retirees may only receive a portion of what they were promised, depending on the funded status of the plan at termination. This is particularly concerning in industries where employers face financial volatility or operate in capital-intensive sectors.

Comparing Alberta to the U.S. and Ontario: A Snapshot

This bar graph highlights the uneven protections available to workers in different regions.

Why This Matters for Alberta Employers and Workers

For employers in Alberta, especially those offering DB pension plans, the lack of a guarantee fund places added responsibility on maintaining adequate funding and proper risk management. It also raises potential reputational and legal risks should the plan become underfunded and fail to meet obligations.

For employees and retirees, it underscores the need for vigilance and awareness. Workers should:

Regularly review plan funding status (available through annual member statements)

Understand their vested benefits

Evaluate the financial health of their employer

Consider how pension benefits fit into a broader retirement planning strategy

Alternatives to DB Plans in Canada: IPPs and RCAs

Given the risk and complexity associated with traditional DB pensions, many Canadian professionals and business owners are turning to alternative retirement vehicles:

Individual Pension Plans (IPPs)

A type of corporate-sponsored DB plan tailored for high-income individuals (e.g., incorporated professionals).

Offers greater contribution room than RRSPs and is highly customizable.

Assets are protected in a trust but not backed by a guarantee fund.

Retirement Compensation Arrangements (RCAs)

Designed for executives and key employees.

Allows for tax-deferred savings beyond standard pension limits.

Also held in trust, but again, not government-guaranteed.

These structures offer a higher degree of control and flexibility, especially for small business owners, but come with their own regulatory and administrative burdens.

A Call for Awareness, Not Alarm

The absence of a PBGC-style pension guarantee in Alberta doesn’t mean the system is broken—but it does mean that Canadian workers and retirees should approach defined benefit plans with a clear understanding of the risks.

While regulatory safeguards and funding requirements offer some protection, they are not substitutes for a formal guarantee. In Alberta, members of private-sector DB plans must rely on the plan’s funding health, the employer’s solvency, and the oversight of provincial regulators—none of which can guarantee full benefits if things go south.

For those planning their financial future, knowledge is power. Whether you’re an employer managing pension obligations or an employee counting on a future payout, it pays to understand exactly what protections are (and aren’t) in place.

💬 Was this helpful? Subscribe for more articles unpacking Canadian retirement policy, financial strategy, and cross-border comparisons.

🔄 Share this with a friend or colleague planning for retirement in Alberta.

📰 Want updates on new pension rules or reforms? Join the mailing list to stay informed.