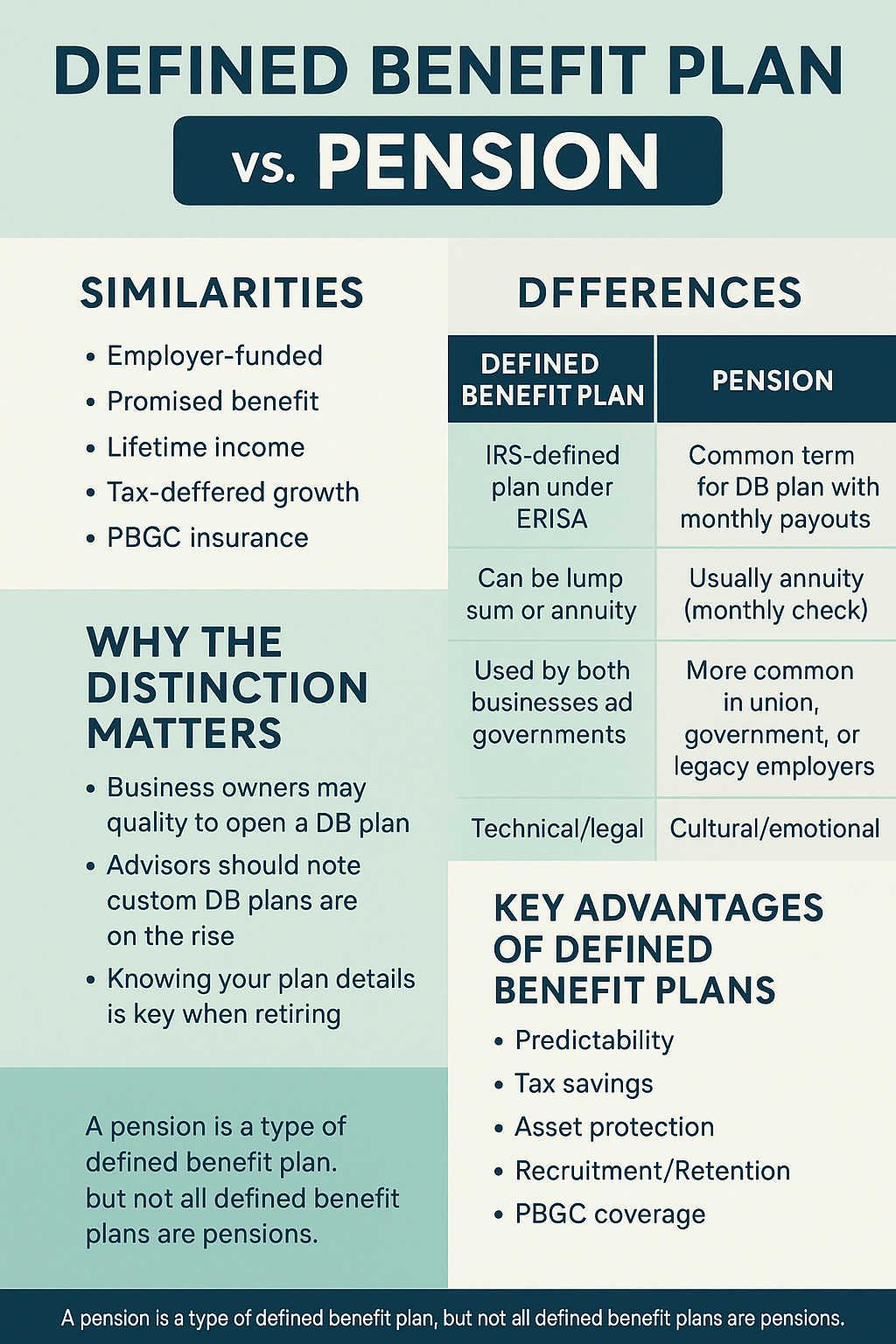

Defined Benefit Plan vs. Pension: What’s the Difference

When most people hear the word pension, they think of a steady paycheck in retirement—usually provided by a long-time employer like a school district, government agency, or large corporation. But dig into the technical details, and you’ll find that pensions are just one form of a broader category of retirement vehicles called defined benefit (DB) plans. While often used interchangeably, the terms have nuanced differences that matter for employers, business owners, and retirement planners alike.

---

What Is a Defined Benefit Plan?

A defined benefit plan is a type of employer-sponsored retirement plan that promises a specific benefit at retirement. That benefit is typically based on a formula involving factors such as:

* Years of service

* Final average salary

* Age at retirement

For example, a plan might promise an annual retirement benefit equal to 2% × years of service × average of the employee’s final three years of pay.

The key feature of a DB plan is that the benefit is predetermined, regardless of how the underlying investments perform. The employer bears the investment risk and is responsible for ensuring the plan is properly funded to meet future obligations.

---

What Is a Pension?

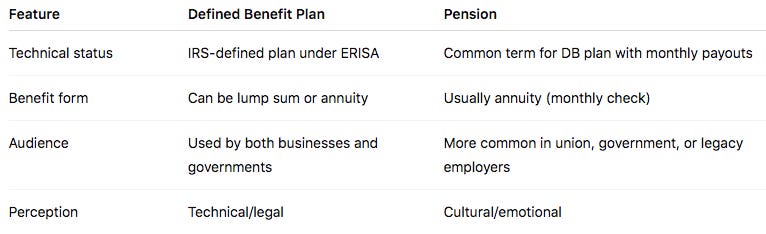

The term pension refers broadly to any retirement arrangement that pays a regular, fixed income after retirement. In the United States, the word “pension” is typically used to describe traditional defined benefit plans—especially those offered to public-sector employees (like teachers or firefighters) or older private-sector employees.

So in practical terms, a pension is a defined benefit plan, but not all defined benefit plans are referred to as pensions. The word "pension" tends to carry more of a cultural or colloquial meaning, whereas “defined benefit plan” is a technical, IRS-recognized category under ERISA (the Employee Retirement Income Security Act of 1974).

---

How Are They the Same?

For most working Americans, there's no real distinction between a pension and a defined benefit plan. They share the same key features:

* Employer-funded: Most or all contributions are made by the employer.

* Promised benefit: The retirement income is calculated by formula, not tied to investment returns.

* Lifetime income: Many plans offer payments for life, with optional spousal benefits.

* Tax-deferred growth: Like other qualified plans, investments grow tax-free until distribution.

* PBGC insurance: Private-sector DB plans are typically backed by the Pension Benefit Guaranty Corporation, a federal agency that insures benefits up to a limit.

How Are They Different?

While a pension is a type of defined benefit plan, several scenarios draw clearer lines between the two terms.

Defined benefit plans can also include more flexible versions tailored to self-employed professionals or small business owners, who may choose to receive their retirement benefit as a lump sum rather than a traditional monthly pension.

---

Why the Distinction Matters

In the legal, financial, and tax planning worlds, understanding the distinction is important:

* If you're a business owner, you may qualify to open a defined benefit plan for yourself and your employees. This often allows six-figure tax-deductible contributions—even if you're the only employee.

* If you're a professional advisor, using the term “pension” might lead clients to think DB plans are outdated or only for large companies, when in fact small, custom DB plans are on the rise among high-earning individuals.

* If you're a participant, knowing whether your plan allows a lump-sum payout or is insured by the PBGC (as most private DB plans are) can influence your retirement decisions.

---

Defined Benefit Plans Today

While traditional pensions have declined in the private sector, custom DB plans are experiencing a resurgence among:

* Physicians, dentists, and lawyers

* Independent consultants or contractors

* Family businesses and owner-operators

These professionals use defined benefit plans to shelter income from taxes, build large retirement nest eggs quickly, and even protect assets through ERISA anti-alienation provisions.

According to the IRS, over 40% of defined benefit plans today are maintained by employers with fewer than 10 participants, showing how far the model has evolved from the massive union-run pension funds of the past.

---

Example: Modern Defined Benefit Use Case

Imagine Dr. Patel, a 52-year-old dentist running a solo practice. She already maxes out her 401(k), but wants to save more for retirement while reducing her tax burden. Her CPA and advisor recommend setting up a cash balance defined benefit plan—a modern hybrid of a DB plan.

With this plan, she can contribute over $150,000 per year, entirely deductible to her business. She’s not running a “pension” in the traditional sense, but she is using a defined benefit plan to achieve powerful tax and retirement outcomes.

---

Key Advantages of Defined Benefit Plans

1. Predictability – Provides a guaranteed income stream, unlike market-sensitive 401(k)s.

2. Tax Savings – Contributions are often significantly higher than defined contribution plans.

3. Asset Protection – ERISA-covered plans are protected from creditors and lawsuits.

4. Recruitment/Retention – Particularly valuable for retaining older or specialized employees.

5. PBGC Coverage – Private plans are insured in case of business failure (up to limits).

---

Are Pensions Dead?

Not quite. While many private companies have shifted to 401(k) plans, pensions remain strong in public sectors. Teachers, military personnel, police officers, and state employees often still rely on traditional pension formulas.

And among business owners and top earners, custom-designed defined benefit plans are very much alive—even if they aren’t always called “pensions.”

---

While “pension” and “defined benefit plan” are often used interchangeably, understanding the differences can be critical for making the right retirement planning decision—especially for business owners or professionals in high-tax brackets.

> “The real value of defined benefit plans today is flexibility,” says Kevin D, venture partner at Defined Benefits.com. “People hear ‘pension’ and think of the past. But modern DB plans can be set up for a solo consultant or a dental practice and allow for hundreds of thousands in annual contributions, all tax-deferred. It’s the most powerful retirement tool most business owners have never heard of.”

Whether you’re receiving a pension or setting up a defined benefit plan for your company, both offer the ultimate reward: income security in retirement.