Loans from Defined Benefit Plans: What You Need to Know About the $50,000 Rule

Defined benefit (DB) plans are known for offering a guaranteed retirement benefit based on salary and years of service. What they’re not commonly known for, however, is allowing participant loans. But under certain conditions, a DB plan can offer loans of up to $50,000 to participants—provided the plan is properly structured and adheres to strict regulatory requirements.

"While it's possible to structure a DB plan to allow participant loans, we rarely recommend it unless there's a compelling business case and proper infrastructure to manage it," says David Combs, Financial Advisor at DefinedBenefits.com. "These plans are designed to deliver predictable retirement income, not function like a credit line. If you're an owner looking for liquidity, it's often smarter to pair your DB plan with a 401(k) loan feature rather than disrupt the pension mechanics."

Below, we break down the rules, caveats, and compliance concerns surrounding loans from DB plans and explain why this feature remains rare despite being technically permissible.

Understanding Participant Loans in a DB Plan

A participant loan allows an employee to borrow against their retirement plan balance under certain conditions. This is a common feature in defined contribution (DC) plans like 401(k)s, but far less so in DB plans due to the unique structure and funding mechanics of pension plans. However, the Internal Revenue Code and ERISA do allow for such loans—if several key conditions are met.

Let’s walk through the specific requirements that make a loan from a DB plan compliant with federal law.

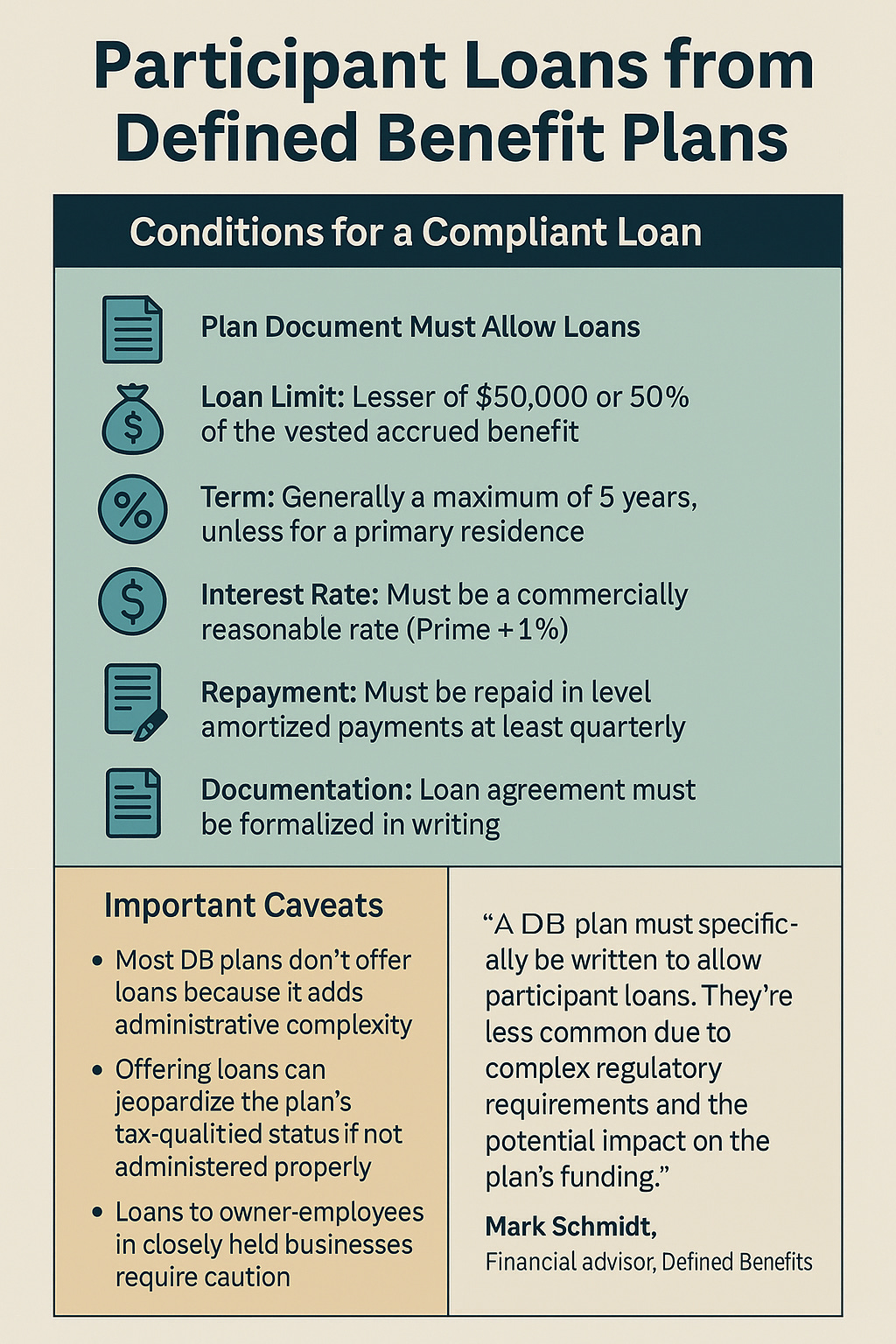

Conditions for a Compliant DB Plan Loan

If a defined benefit plan sponsor wishes to offer participant loans, it must be done within a carefully regulated framework. These are the foundational elements that must be present:

1. Plan Document Must Allow Loans

A DB plan cannot issue loans unless it explicitly permits them in its governing plan documents. This requires a written loan policy that must be approved by the plan fiduciary or trustees. The policy should detail the terms, process, and conditions under which loans can be requested and approved. Without this language, any loan issued from the plan is automatically non-compliant.

2. Loan Limit: $50,000 or 50% Rule

Just as with 401(k) loans, the Internal Revenue Code limits participant loans to the lesser of:

* $50,000, or

* 50% of the participant’s vested accrued benefit in the plan.

This means that if a participant has a vested accrued benefit of $60,000, they can borrow no more than $30,000. If they have $150,000, the limit is capped at $50,000. This limitation ensures that loans do not overly deplete retirement balances or destabilize the plan's funding.

3. Term Limits: Five Years or Primary Residence Exception

The loan must generally be repaid within five years, with no exceptions unless the purpose of the loan is to purchase the participant’s principal residence. In such a case, a longer repayment term may be allowed—often 10 to 15 years—so long as it is clearly justified and documented.

4. Interest Rate Requirements

The interest rate charged must be “commercially reasonable.” In most cases, this is interpreted to mean the Prime Rate plus 1%. Charging a lower-than-market rate can be viewed as a prohibited transaction or a deemed distribution, both of which can have severe tax consequences. The loan should reflect terms that an independent lender would offer under similar conditions.

5. Amortized Repayment and Payment Frequency

Loans must be repaid in a series of level amortized payments (principal plus interest) made at least quarterly. This means no balloon payments and no interest-only structures. Regular payment schedules help preserve the tax-deferred status of the loan and prevent it from being recharacterized as a distribution.

6. Proper Documentation and Loan Tracking

Each loan must be formalized with a signed promissory note and amortization schedule. The loan must be monitored closely to ensure timely repayments. If a loan goes into default, the unpaid balance is treated as a distribution, triggering income taxes and potential early withdrawal penalties. Accurate records are essential for compliance and IRS audits.

Why DB Plans Rarely Offer Loans

Although technically allowed, participant loans are rarely included in defined benefit plans for several reasons—most of which revolve around complexity, risk, and administrative burden.

Actuarial Disruption

Defined benefit plans rely on complex actuarial calculations to determine funding obligations. When a loan is issued to a participant, it alters the liability side of the plan’s balance sheet. This makes it harder for actuaries to estimate the plan’s future obligations and may lead to underfunding or overfunding if not recalibrated correctly. For that reason, actuaries generally discourage including loans in DB plans.

Administrative Complexity

Loan servicing—including calculating interest, processing payments, monitoring delinquencies, and maintaining accurate records—requires robust administrative systems. Most DB plans are set up with a long-term retirement horizon in mind, not for short-term liquidity functions like loans. Adding this feature requires significant coordination between plan administrators, third-party administrators (TPAs), and actuaries.

Risk to Plan Qualification

Failure to comply with any of the IRS or Department of Labor rules surrounding participant loans can result in penalties or disqualification of the plan’s tax-qualified status. This means the entire plan could lose its tax-exempt treatment, exposing the sponsor and participants to immediate taxation and penalties. The stakes are high, particularly in smaller or closely held businesses where compliance processes may not be robust.

Loans to Owner-Employees: Higher Scrutiny

Loans from a DB plan to an owner-employee (e.g., the sole owner or a majority shareholder in a small medical or dental practice) are particularly risky. These loans are subject to heightened scrutiny under prohibited transaction rules. The IRS and DOL take a hard stance against any self-dealing, and a loan that benefits the business owner must be impeccably documented and justified. Even a minor deviation from compliance can result in severe tax penalties or plan disqualification.

In practice, many ERISA attorneys advise against offering loans to owner-employees altogether because the potential downside outweighs the short-term liquidity benefit.

Better Alternatives: DC Plans and Separate Arrangements

Because of these challenges, employers who want to offer participant loans typically do so through a 401(k) or other defined contribution plan. These plans are more flexible, do not rely on actuarial assumptions, and are widely supported by recordkeepers and plan administrators with automated loan servicing platforms.

In some cases, a business owner may maintain both a DB plan and a 401(k) plan side-by-side. This allows them to benefit from the retirement security of a DB plan while retaining the liquidity and flexibility of loans through the 401(k). For closely held businesses or professional practices, this dual-plan structure can be an effective solution.

When Does a DB Plan Loan Make Sense?

Despite the risks and complexity, there are rare scenarios where offering loans through a DB plan may make sense:

* A large, professionally managed pension plan with significant participant demand and administrative resources.

* A union-sponsored or public-sector DB plan that has built-in infrastructure for loan processing.

* A legacy plan that already includes loans and has maintained long-term compliance with minimal disruption.

In these cases, the cost of compliance and administration may be justified by the benefit to plan participants. However, for most small to mid-sized employers, especially those in professional services, it’s usually not worth the risk.

Compliance Checklist for Sponsors Considering Loans

If you’re seriously considering adding participant loans to your defined benefit plan, here’s a simplified checklist of steps you’ll need to take:

1. Amend Plan Documents – Include explicit loan language and approval by the plan fiduciary.

2. Develop a Loan Policy – Outline procedures, limits, repayment terms, and eligibility.

3. Coordinate with Actuary – Ensure loans won’t disrupt funding or violate plan assumptions.

4. Implement Administrative Support – Establish systems for tracking loans, payments, and defaults.

5. Review with ERISA Counsel – Seek legal opinion on any transactions involving owner-employees.

6. Train Staff – Ensure HR and payroll know how to handle loan repayments.

7. Monitor Ongoing Compliance – Regularly audit outstanding loans for payment and documentation.

These steps are crucial to avoid prohibited transactions and ensure the plan remains in good standing with regulators.

Conclusion: Technically Possible, Practically Rare

While a defined benefit plan can legally offer participant loans—including up to $50,000—it’s rarely a good idea for most employers. The compliance burden, actuarial impact, and risk of IRS scrutiny make loans from DB plans a high-maintenance feature with limited upside. Unless your plan is unusually large and well-resourced, it’s best to explore other options—such as a companion 401(k) plan—if loan availability is a key goal for you or your employees.

For most business owners and plan sponsors, the best move is to focus on what DB plans do best: delivering predictable, tax-efficient retirement income—not short-term borrowing.