Case Study #1: A Defined Benefit Portfolio Strategy for a Dentist

“Dentists tend to be risk-averse by nature, which makes defined benefit plans particularly attractive—especially when backed by the PBGC guarantee. It allows them to invest meaningfully in their region and future while knowing the government stands behind their retirement benefits. With the right allocation, they get both long-term upside and institutional-grade security,” said Robert Mowry, Partner at Defined Benefits.

What’s compelling about a single-employer defined benefit plan is that, within ERISA guidelines, it allows for tailored portfolio construction—enabling the investment manager to allocate capital toward sectors or impact areas the contributing professionals care deeply about, such as San Diego-based ventures and MedTech innovation.

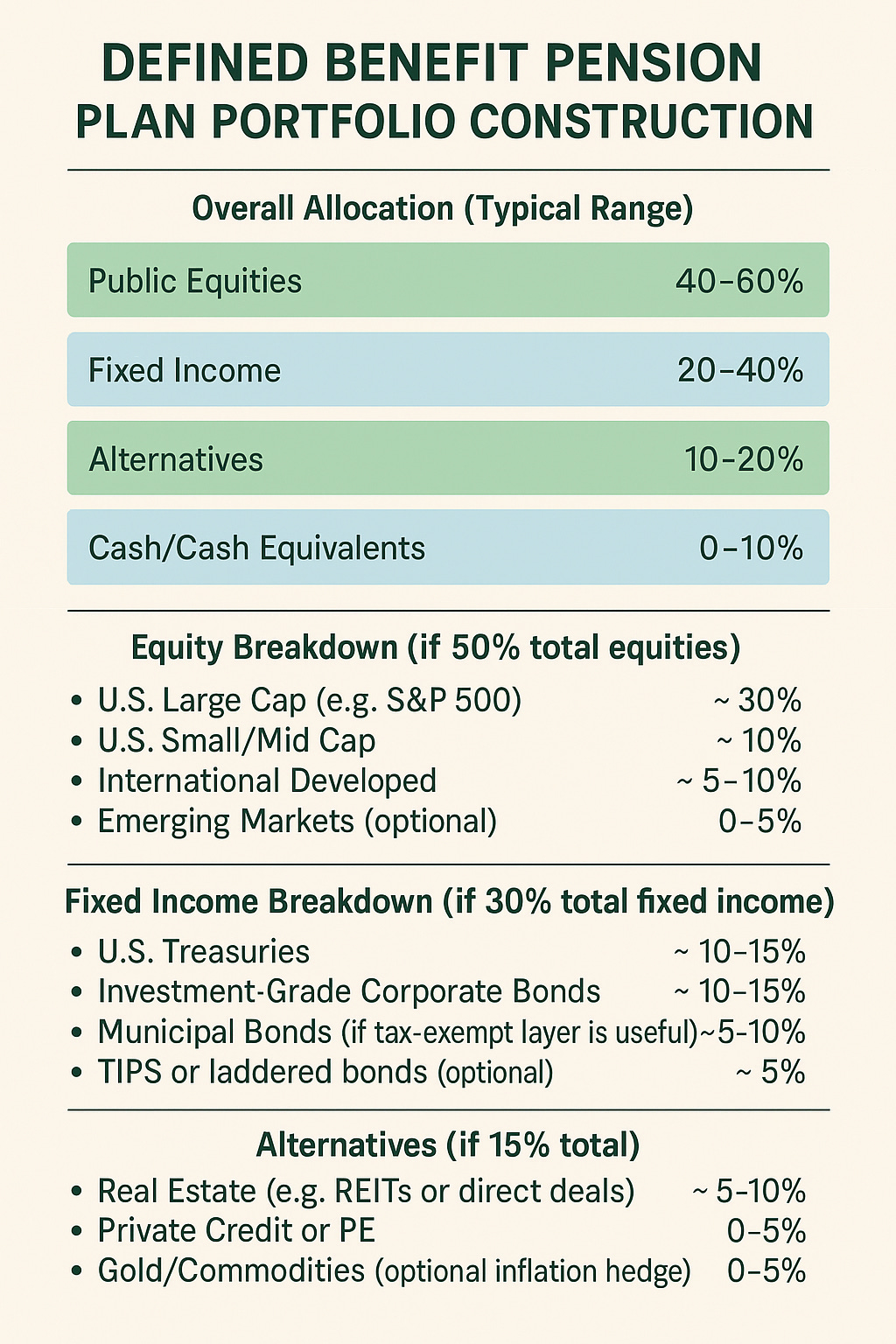

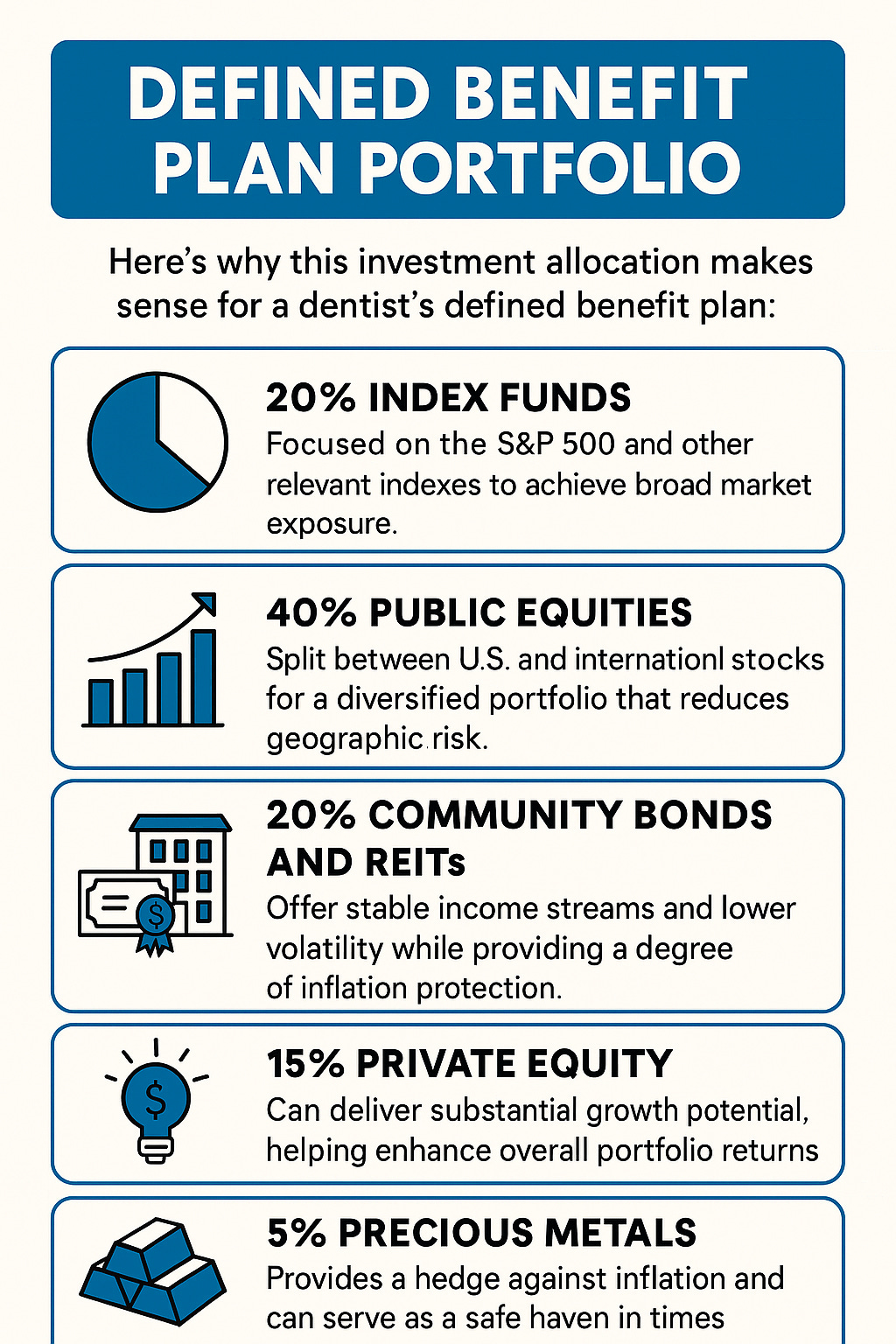

The following allocation presents a balanced, diversified approach.

20% Index Exposure (S&P or Major Benchmarks):

Including broad index exposure through funds tracking the S&P 500 or global benchmarks ensures the portfolio participates in general market growth while reducing single-stock risk. For a dentist, who is likely seeking consistent returns and limited oversight responsibilities, index funds offer a low-cost, tax-efficient solution. They help align the portfolio’s growth with economic trends and inflation, maintaining the purchasing power of retirement benefits over time.

40% Public Equities (50% U.S., 50% International):

A diversified allocation to public equities remains essential for long-term appreciation. Splitting this equally between U.S. and international markets hedges against regional downturns and allows the plan to benefit from global growth. U.S. equities, especially large caps, offer stability, while international exposure provides access to faster-growing or undervalued markets. For a DB plan reliant on growth to meet long-term obligations, this diversified equity core offers the best opportunity to outperform inflation over multiple decades.

20% Community Bonds and REITs:

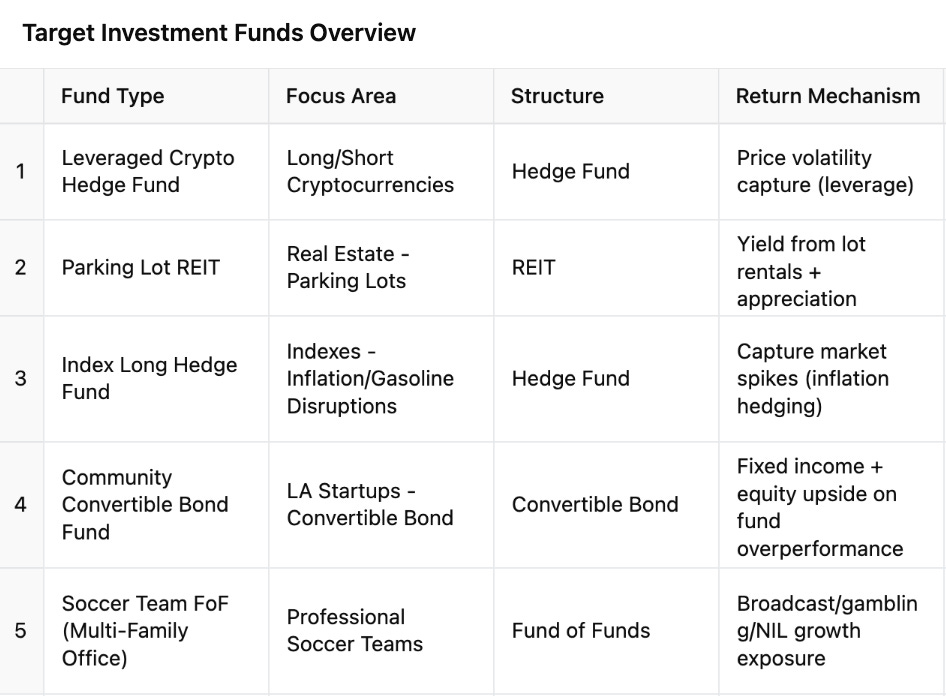

Including fixed income and real estate assets creates ballast for the portfolio. Community bonds—especially those with a social or regional impact like LA startup convertible bonds—offer stable, semi-predictable income and potential upside, aligning with the dentist’s desire for both return and community support. Pairing this with REITs (focused, for instance, on infrastructure or parking lots) adds diversification and a hedge against inflation, given real estate’s historical correlation with rising prices. This component offers yield generation, critical for smoothing returns and helping to match future benefit liabilities.

15% Private Equity:

Dentists often have the ability to tolerate moderate illiquidity in exchange for higher potential returns. Allocating 15% to private equity—such as growth-stage healthcare or consumer-focused funds—enhances upside without overexposing the plan to risk. Private equity’s historically strong long-term performance makes it a useful vehicle for boosting overall return targets in DB plans, especially when designed to exceed actuarial assumptions. Additionally, exposure to private markets allows for differentiated returns that don’t move in lockstep with public markets.

5% Precious Metals:

Although a small portion of the portfolio, precious metals (e.g., gold, silver) serve as an effective hedge against systemic risk, market volatility, and currency devaluation. In a DB plan context, this allocation adds diversification and serves as a store of value during periods of financial stress, complementing the plan’s broader focus on growth and stability.

Conclusion:

This portfolio is designed with the unique needs of dentists in mind: capital preservation, tax efficiency, inflation protection, and long-term growth. It benefits from diversification across geographies, asset classes, and liquidity profiles to meet actuarial goals and ensure retirement security. It's simple enough to manage, yet sophisticated enough to meet the fiduciary responsibilities of a modern pension sponsor.

University endowments often see private equity as a leading driver of returns, frequently outperforming other asset classes over long time horizons. While many of these gains begin as unrealized, or "paper" profits, the scale and influence of large venture funds often enable them to push portfolio companies into the public markets, ultimately realizing those returns. This dynamic underscores the potential power of private equity when backed by sufficient capital and strategic alignment.

When I look at private equity funds, I like.

I like to take the temperature on what makes people feel more secure in retirement—please take this quick poll to contribute to our research.